The baseline GE Digital APM database contains a Risk Matrix that you can use when evaluating risk, but if you do not want to use the baseline values, an administrative user can customize the default Risk Matrix or create a new Risk Matrix. The values that you see in the Risk Matrix are determined by various records. Here we discuss the categories of risk rating along with the example, advantages, and disadvantages.The Risk Matrix that appears in the Risk Assessment window allows you to make selections that are used in calculations to determine an overall risk rank value. This has been a guide to What is a Risk Rating and its Definition.

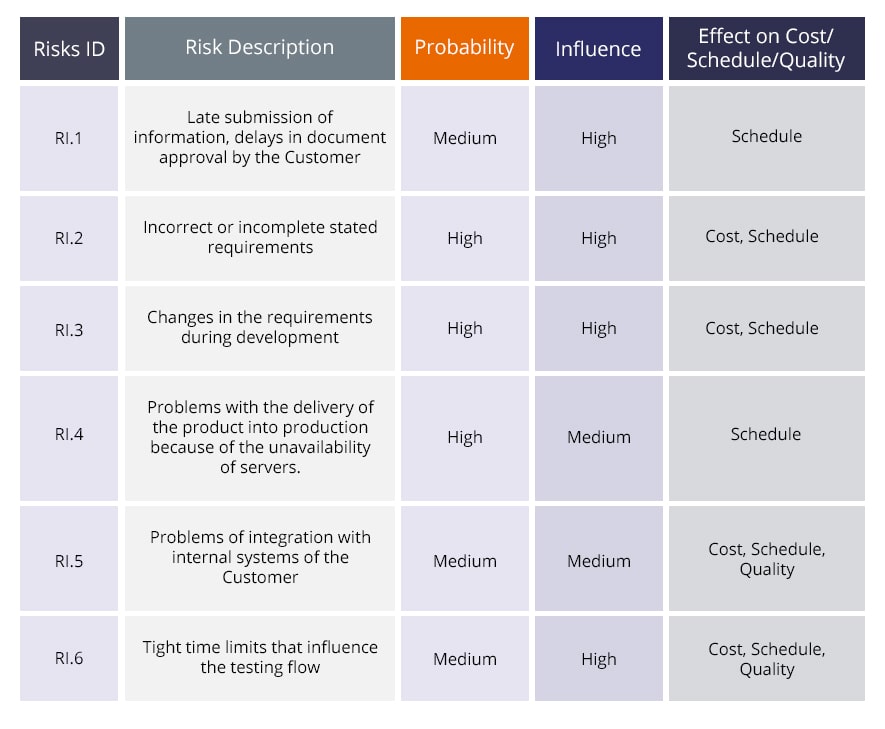

It enables a business to be well informed about all the potential risks that can cause an impact to the business along with the likelihood of the event’s occurrence. Organizations should consider in conducting at least a yearly review of the risk rating due to the fast-paced business environment. Risk Rating refers to the classification of risks and their impacts on the business in terms of reputational or economic damage to an organization or a sector. This is a complex process and requires a high level of experience and thoughtfulness to foresee potential risks that can impact the smooth functioning of the business. This is an assumption of the impact it can have on the business which if not done diligently can cause economic and reputational damage to the organization which may eventually result in loss of business. Event risk helps in a better understanding of the risk and working towards enhancing the current procedures. Studying the risk involved in a business activity helps in taking appropriate measures to either curb the effects of the risk or completely eliminate the risk. read more it would be something that happens in a month or so. For example, for a fast-food company, a frequent likelihood rating will be something that can happen every day whereas for an investment bank Investment Bank Investment banking is a specialized banking stream that facilitates the business entities, government and other organizations in generating capital through debts and equity, reorganization, mergers and acquisition, etc.

This rates the risk on the basis of its recurrence which can change depending on the type of the business that is being considered.

High: A major event that can cause reputational and economic damage that will result in huge business and client base losses.Medium/High: Severe events that can cause a loss of business but the effects are below a risk that is rated as high.Medium: An event that would result in risks that can cause an impact but not a serious one is rated as medium.Low/Medium: Risk events that can impact on a small scale are rate as low/medium risk.Low: A low rated event is one with little / no impact on the business activities and the reputation of the firm.This is the common pattern of risk across businesses. Risk is rated on the impact on the business which can be economic or reputational and its likelihood of occurring in the near future.

0 kommentar(er)

0 kommentar(er)